What should I buy?

With so many different brands out there, it can be challenging to know exactly what is the right product to buy. Our team at Bayside Bullion have many decades of experience within the Bullion Industry and are here to assist you in making the right decision. If you have any questions, please reach out to any of our staff who can step you through each option to suit your individual goals.

-

Minted or non-Minted bars?

While some products come with Assay Certifications, Tamper proof packaging and Certificates of Authenticity, these can all be faked and therefore should not be relied upon as the single deciding factor.

Many minted products are counterfeited due to them being easier to pass off while enclosed in their packaging. For this reason, it’s always important to only buy minted products from a reputable Bullion Dealer who can verify authenticity using a non-destructive precious metals tester like XRF (X-ray Fluorescence Spectroscopy). It is also why the cast bars (non-minted products) usually sell better privately as it is much easier for individuals to spot a fake product without the need of having access to expensive testing equipment.

-

Gold or Silver?

Both Gold and Silver generally increase/decrease in price together however historically, Silver has always traded with more volatility. This can be great when prices are rising but less favourable during a correction. We believe for this reason it’s always good to have an allocation of both Gold and Silver in your portfolio so that you have the option of selling either metal depending on where the prices are going.

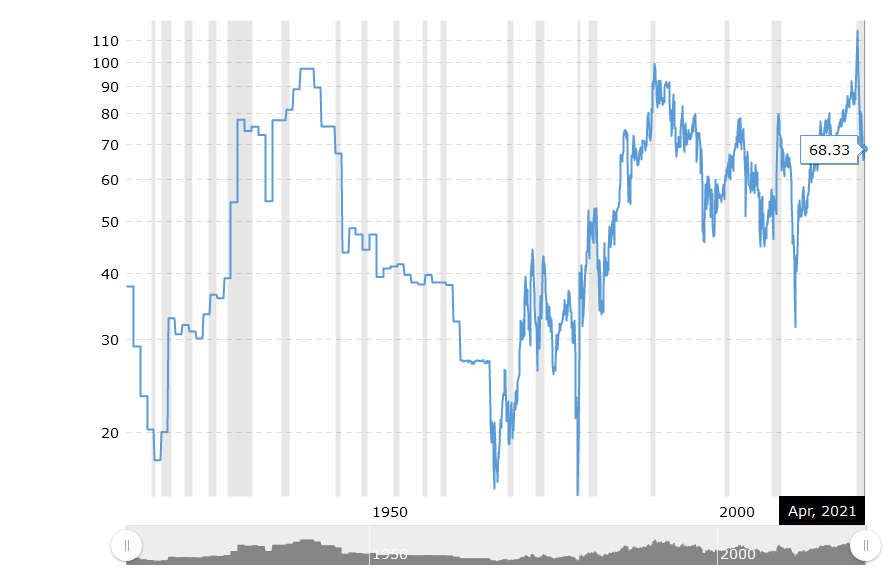

By taking the Gold price and dividing it by the Silver price we can see what is the Gold to Silver ratio is at any point (referred to as ‘GSR’). The GSR ratio therefore shows a relative measure of which metal is outperforming to the other. At the time of writing this, the current GSR ratio is 68:1. This means 68 ounces of Silver is at the same price as 1 ounce of Gold. Only 12 months ago (March 2020) this ratio was over 125:1, which shows us Silver has continued to outpace Gold. This is an example of the ‘favourable’ price movement where it’s taking less ounces of silver today to buy 1 ounce of gold than it did 12months ago.

The Historic averages of GSR suggest this ratio could be heading below 10:1 in the future as more and more Silver is consumed by industry.

https://www.macrotrends.net/1441/gold-to-silver-ratio

Which Brand to Buy?

Bayside Bullion stocks and sells both minted and non-minted products however we recommend the Metal Money range of Bullion.

We find strong points of difference when dealing with Metal Money as compared to other suppliers in their customer service and quality. Not only does Bayside Bullion strongly believe in supporting local business, but Metal Money also provides a world class product at the lowest premium. They have grass roots in QLD and have endorsed Bayside Bullion to be an authorised reseller of their products. For Bayside Bullion to be able to deal with a local company is very beneficial as it negates the risk of shipping product all over Australia. As we also save on shipping, freight costs plus insurance we are able to pass these saving directly onto the consumer, meaning that’s more metal in your pocket.

Metal Money bullion is created using the latest state of the art refining and barring equipment to enable the production of premium quality products. They guarantee the purity of each bar they produce. Gold bullion is produced at 9999+ quality while silver purity is 9995+. The purities stamped on all Metal Money bars adhere to the world standards.

All bars are meticulously tested and inspected before they leave the refinery. All metal goes through rigorous ICP (Inductively Coupled Plasma) Analysis followed by XRF (X-ray Fluorescence Spectroscopy) Testing. All bars are weighed and re-weighed on calibrated industrial weighing equipment and visually inspected before being sealed up in individual airtight packaging and transported directly to our sales office.

-

What bar size to buy?

It is true that it costs less per gram to buy a larger bar since there is fewer labour costs involved. It takes approximately 10 times more labour to produce 10x 1oz Gold bars as it does to produce 1x 10oz Gold bar. However, with the 10 x 1oz bars, you can sell on 10 separate occasions. With the 10oz bar, you will only have one occasion as it’s not possible to sell a percentage of a bar. As a result, important to select the correct size when you are initially buying to avoid costly mistakes of trying to swap out bar sizes later.

We recommend buying bullion (and therefore a dollar allocation) in a size that reflects your future requirements. A retired couple travelling around Australia may prefer multiple smaller bars to fund ongoing costs where another couple holding a house deposit might choose a single larger bar.

If you would like the option to selling your investment in increments then it may be the best long-term option to buy multiple 1/2oz or 1oz Gold bars over say a 500g or 1Kg Gold bar. However, if you are certain, you will be disposing of it all in one go then perhaps the larger bars will be the better option for you in that scenario.

To simplify, think about your likely ‘exit strategy’ requirements today, which will help decide the best size bar(s) for the future.

Conclusion

1 – Choose either Gold or Silver

2 – Choose either Minted or non-Minted product

3 – Choose a suitable size/quantity based on your ‘exit strategy’